By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Real Estate Snapshot

What’s the outlook for real estate in 2025? In 2024, long-term interest rates rose, then fell, then rose again; this graph gives a long-term perspective on mortgage rates:

While down from their peak in 2023, mortgage rates remain at levels largely unseen since the Financial Crisis of 2008. Inflation fears, tight monetary policy by the Fed, and fiscal deficit and debt concerns have likely contributed to this rate rise; tariff worries and global uncertainty may also have had an impact. It’s possible that longer-term rates will decline in 2025, but hardly guaranteed—the Fed and markets believe that the federal funds rate will only drop about 50bp this year.

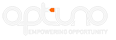

The overall outlook for the commercial real estate market is mixed. A Moody’s analysis noted that the office sector has struggled with vacancies:

The review did suggest, however, that the office sector may be stabilizing after the pandemic-induced shift to remote and hybrid work. JPMorgan also expressed cautious optimism that the office market may be normalizing.

Multifamily housing saw mixed results, with increased construction in some metro areas, such as Austin and Raleigh-Durham, leading to higher vacancy rates. However, such imbalances between supply and demand may dissipate over time.

The retail and industrial sectors have been steady over the past year in terms of vacancies; the retail sector has benefitted from the strong economy and consumer demand, while the industrial sector is seeing its construction surge soften under higher interest rates and cooling demand.

Vacancy rates are about 6% for the apartment sector, 20% for the office sector, 10% for the retail sector, and 7% for the industrial sector.

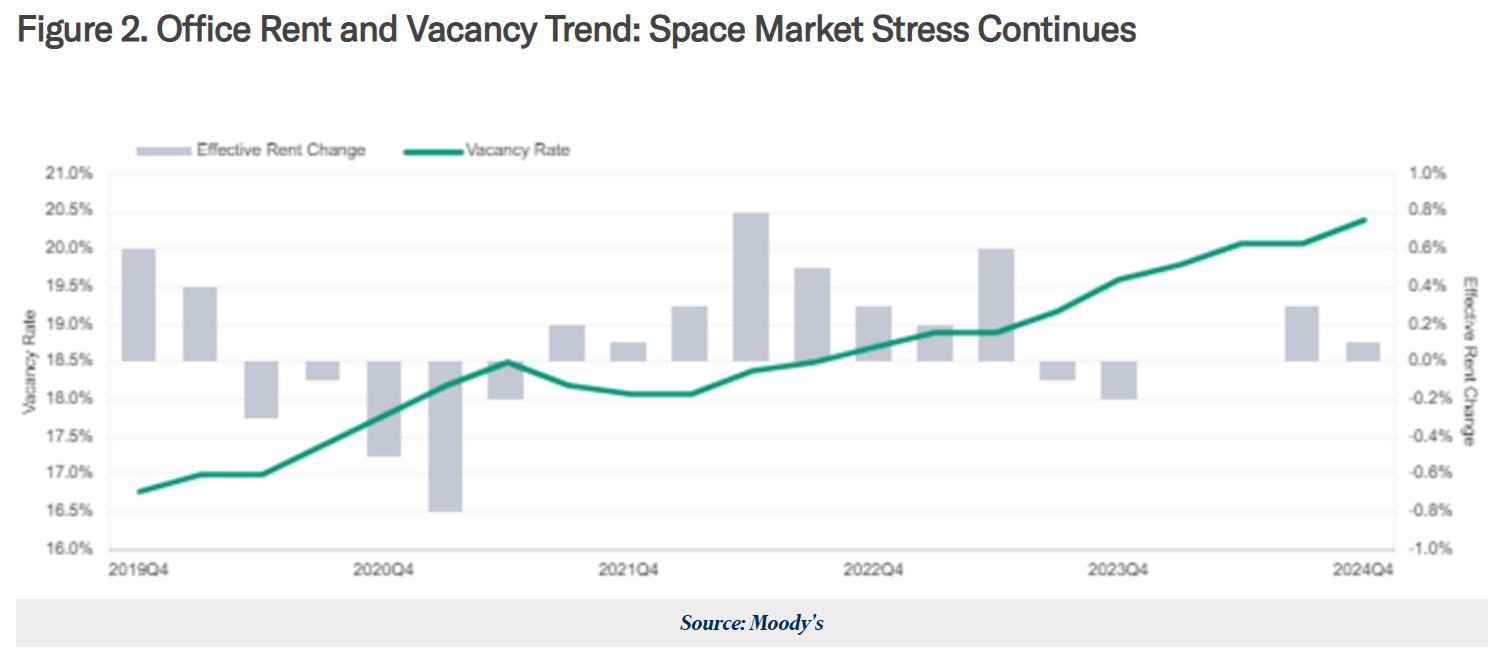

Cap rates range from 5%-7% for each of these sectors, with multifamily and industrials coming in between 5.0% and 5.5%, and office and retail coming in at about 6.5%. CBRE projects cap rates to fall by 20bp-40bp in 2025, and stabilize at around 4.5%-4.6% for the multifamily, retail, and industrial sectors, and at about 5.0% for the office sector. These cap rates are higher than those seen pre-pandemic, largely due to higher long-term interest rates.

‹ Back